Today’s customer service expectations cross over industries. If a consumer has a positive experience in one industry, they’ll expect it in another. Because of this, today’s clients are likely to judge the customer support from their bank by comparing it to other experiences like paying a phone bill online or ordering food on a delivery app.

With these retail-based, transactional services now setting the bar for customer experience, financial institutions are no longer just competing with others in their industry – they’re being compared to every digital experience that their client has ever had.

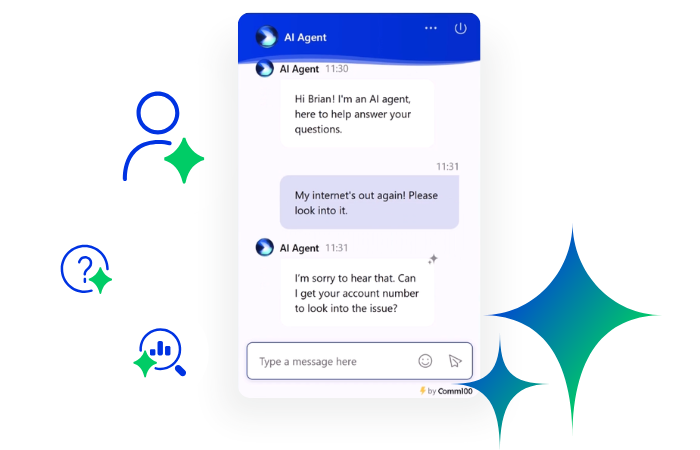

This makes live chat for financial institutions an absolute must. Live chat is easy to use, quick, and most importantly, convenient. Many clients now prefer to use this technology rather than visiting a branch, or even calling in. In fact, 79% of clients now prefer customer support through online chat.

Having said that, offering live chat is just the first step. To really take advantage of this channel, there are many factors you need to look at. So as a financial services and banking professional, how can you deliver the best live chat support to your clients?

To begin, they need to understand how well they are performing compared to others in their industry, as well as those outside of it. To help you on this journey, this blog reveals the key financial services and banking metrics from our 2022 Live Chat Benchmark Report, alongside top live chat best practices that will help you to gain your clients’ trust and loyalty.

Live Chat Benchmark Report 2025

Discover the latest live chat benchmark data to understand how well your team is performing compared to the competition and where it needs to improve.

Download the report

Report

Wait time

Wait times are key to any customer service team. From analysis of our 2022 Live Chat Benchmark Report, we found that live chat teams in banking and financial services have a wait time of 36 seconds. The average across industries is 35 seconds, so this is a strong score.

Moreover, average wait times for phone is almost 90 seconds. A key reason for lower wait times for live chat is chat concurrency, a feature that phone simply can’t have. While agents can only take phone calls one at a time, they can handle multiple chats concurrently. A recent report by Forrester, The State of Chat in Retail 2021, has found that well-trained agents can handle five to seven chats at the same time.

While wait times for financial services and banking are low, it could still be improved on – after all, low wait times are one of the top signs of a great client experience. To help keep wait times low, here are some top best practices:

– Take advantage of intelligent agent tools

The more robust live chat platforms offer internal knowledge bases so agents can quickly find the information they need to help the customer without even leaving the chat window. Also, don’t forget to take advantage of extra agent tools such as canned messages and keyboard shortcuts to reduce the time-consuming work of crafting every response.

Agent Assist, a type of agent-facing AI, takes this up a level by scanning the conversation in real time and providing agents with suggested answers. This keeps agents from having to search for answers, empowering them to deliver rapid-fire responses that have been vetted for accuracy.

– Encourage self-serve

The more clients that resolve their issue without agent support, the lower your wait times will be. This is known as self-serve, and the great news is that it is a popular and expected channel – 70% of customers expect a company’s website to include a self-service application.

A strong knowledge base is core to self-serve and should be accessible on any site. Better still, integrate your knowledge base within the live chat window so when a client opens a chat, they can perform a knowledge base search within the chat window before they start a conversation. This helps to reduce the number of common queries coming through to your agents, and so contributes to lower wait times.

“We thought we should really have the ability to chat with our customers through our website. Our younger generation – how they communicate is through text – to them that’s talking! This is a way to communicate with our members, and the more ways we give them to communicate with us the better we feel we are at keeping a solid relationship.”

Colette Branigan, Affinity Credit Union

Read the full story: Comm100 helps Affinity Credit Union improve both agent efficiency and customer experience

Chats per agent per month

Our benchmark data shows that financial services and banking have a high chats per agent per month at 1193, far above the average. While this is likely partly due to the financial issues caused by the pandemic, it also shows just how popular live chat is with banking clients.

However, the fact that financial institutions are still retaining low wait times on average indicates that they are by and large using live chat effectively. Here are two key ways that financial institutions can keep wait times low and CSAT high, while managing a high chats per agent volume.

– Chatbots

Chatbots are the ultimate tool to manage high customer support volumes. With an intelligent AI chatbot working across live chat (as well as social media and SMS), a large portion of frontline support can be automatically managed and resolved without any human involvement. This helps to curb queues and wait times, while allowing agents to focus on more high-value customers and queries. Chatbots can also maintain an unlimited amount of simultaneous chats 24/7, relieving the burden off live agents and keeping clients happy.

Recommended Reading: Transforming the Financial Services Client Experience – Taking the Next Step with AI

– Advanced queue management

A strong live chat platform should allow you to set up intelligent chat distribution rules to help you manage queues and wait times. Queue management tools allow you to distribute chats to specific agents or departments according to a predetermined set of rules, enforce chat load limits for agents based on variables such as experience or ability, and set up redirect rules to back-up departments in case of overflow.

Chat duration

Chat duration varies widely across industries, primarily due to the nature of the conversation. In our Live Chat Benchmark Report, we discovered that chat duration within financial services and banking teams sat below the average at 9 minutes 50 seconds.

A lower chat duration obviously has its benefits, allowing agents to handle more agents in a given time. However, over the past year, we have seen a significant shift in priorities due to the growing emphasis on customer experience. Partly due to the pandemic, managers have begun shifting value away from shorter chat duration (and so time to resolution) in favor of developing relationships with clients – and allowing agents to take longer to resolve queries.

This is not to say that financial institutions should allow chat duration to get out of control. Instead, it shows that there is a greater interest in the client experience, and so teams are recognizing the need to balance speed with quality of service. Here are some tops ways live chat teams can improve the client experience:

– Utilize data for a more personalized experience

Nobody likes being treated like they are just one of many. This is why personalization in live chat is key to delivering the very best client experience, and your agents can only do this with if they have data at their fingertips.

With an intelligent live chat platform, your agents have access to a wealth of information about the client they are speaking to, especially if you integrate it with other core data systems like your CRM. With a unified agent console, your agents can instantly know who the client is, what service they are using, previous conversation history, and so much more – all without even asking. With all this information at hand, your agents can deliver the personalized, fully contextualized service your clients expect.

– Use audio and video chat

The inability to see customers in person has been hard on many financial institutions who rely on face-to-face communication and branch visits. Luckily, the very best live chat platforms support this experience with audio and video chat.

Audio and video chat allows financial institutions to establish face-to-face relationships with their clients. It makes the experience more human, and even helps to increase trust in the agent. Building relationships like this can result in improved customer satisfaction and are key to loyalty.

With audio and video chat, agents can also more easily walk their clients through complicated issues. Screen sharing helps here too – by allowing an agent to view the visitor’s keyboard and mouse, they can assist them quickly and conveniently in both sales and technical support. Screen sharing is particularly effective in tackling more complex website-related issues or guiding customer through troubleshooting steps.

Mobile chats

Millions of people log into mobile banking every single day, with 59% of clients stating they prefer it over visiting a branch in person or calling in to check their balance.

Perhaps unsurprisingly, the popularity of mobile in chat is no different. In 2020, 56% of live chats were made on mobile for financial services and banking organizations. This is an exceptionally high number, especially given that much of 2020 was spent at home for most people due to the restrictions of Covid-19. This meant they had greater access to desktop or laptops and so were less reliant on mobile, and yet mobile chats still remained high.

This stat once again reinforces the need for financial institutions to embrace mobile and ensure that their chat is optimized for mobile. The chat experience will look completely different on mobile versus desktop. Financial institutions should take care to ensure all the design elements are optimized for mobile, or else they risk providing frustrating and negative experiences when users are trying to reach out for support.

Furthermore, financial institutions should also be as accessible or even more accessible through mobile chat as they are through live chat. This includes not only deploying live chat on their mobile website, but also in their mobile banking app.

Lake Michigan Credit Union, for example, integrated live chat with their mobile app to provide members with native support and increase engagement. Read the full story here and find out how Lake Michigan Credit Union scales better member engagement with Comm100 Live Chat.

Wrap-up

Live chat is giving financial institutions the chance to enhance the quality of service they offer clients with real-time support that’s quick, easily accessible, convenient, and secure. It is a vital component of a comprehensive, digital client experience strategy that will ensure your organization responds successfully to changing client expectations.

Financial Services & Banking Customer Service Software

Deliver personal 1-1support at scale, securely

Learn more

Solution